I mentioned last week that I’d have a big announcement this week for Black Friday. It’s going to change the way you look at selling houses and I’m totally excited to share it with you.

In the mean time, I have a little quiz… I want to see how well you know your stuff 😉

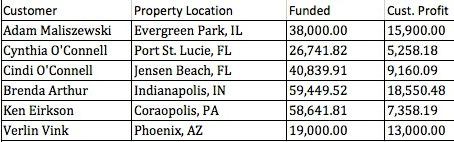

As you know, we fund deals for our clients on a regular basis. The following are very recent examples of deals we’ve funded.

They’re also special because they share a few things in common:

4 Common Components

1. They were all REO’s – the tide is rising

2. They were all done using iFlip – no surprise, it’s powerful

3. They were all junkers sold to investors – wholesaling rocks!

4. They were all sold to cash buyers – they’re lots easier to deal with

Here is the quiz…

Which one of the above 4 common components do you think is THE most important to YOU when doing deals and cashing paychecks without the PITA of the deal falling apart and you having to scramble to save it.

My BIG announcement this week is going to address the correct answer to this quiz.

Let me know which one you think is most important and leave your answer below.

Stay tuned for more news!

Jarad

I think all of them are important. Without one of those components you have no deal.

The answer is 4

#4 – REO’s are everywhere; deal analyzer software is abundant – some better than others, and there is a burgeoning pipeline of junker properties. However, these three essential components have no teeth if you can’t close the sale quickly. Cash buyer is king. I have been bogged down repeatedly with FHA and conventional buyers. Its like running in ankle deep mud: a great deal of effort is put into it, but you only go a short distance before exhaustion, and frustration take over.

I think the most important aspect is #1. As you say, they are becoming more and more available and the banks are finally seeing the need to get rid of this inventory.

But the others are important too. I’m just getting started, but I expect #2 will be a big advantage for me as I begin the process, and #3 is where I plan on starting out. To me, #4 could be the least important, but it is obviously the easiest method.

I believe it is #4 without exception. Without cash buyers hard to make a sale….

All of them are important but I think cash buyers is the most important.

Answer: 4. They were all sold to cash buyers – they’re lots easier to deal with

CASH is always KING. Number 4 for me

All four are important & correct but I believe number 4 tops the list!!!

need more information. how motivated are the owners of these properties to begotten rid of and what is the situation that motivates them. i am not looking to buy , my strategy is to solve owners problem, utilizing one of my tools in my tool box. example sub2/ options, or owner financing them flip to a wholesaler or tenant buyer.

Cash buyers without a doubt

Number four is the most important component.

At first look I went with #2 iflip funding because that is what is holding us up. But certainly a cash buyer, #4, is most important to do the deal quickly and cleanly.

The cash deal is the best way to accomplish the flip. I have two house I have tried to flip wiht no success. I am trying to refi both houses and am at teh mercy of the mortgagte Co. Both are rented but am on pins and needles waiting for thier answer. Too many foreclosures in the market too compete with even with an update house. I go with #4.